Blog Home

3 safe ways to sell a financed car to a private buyer

Selling a car you still owe money on: your safest options

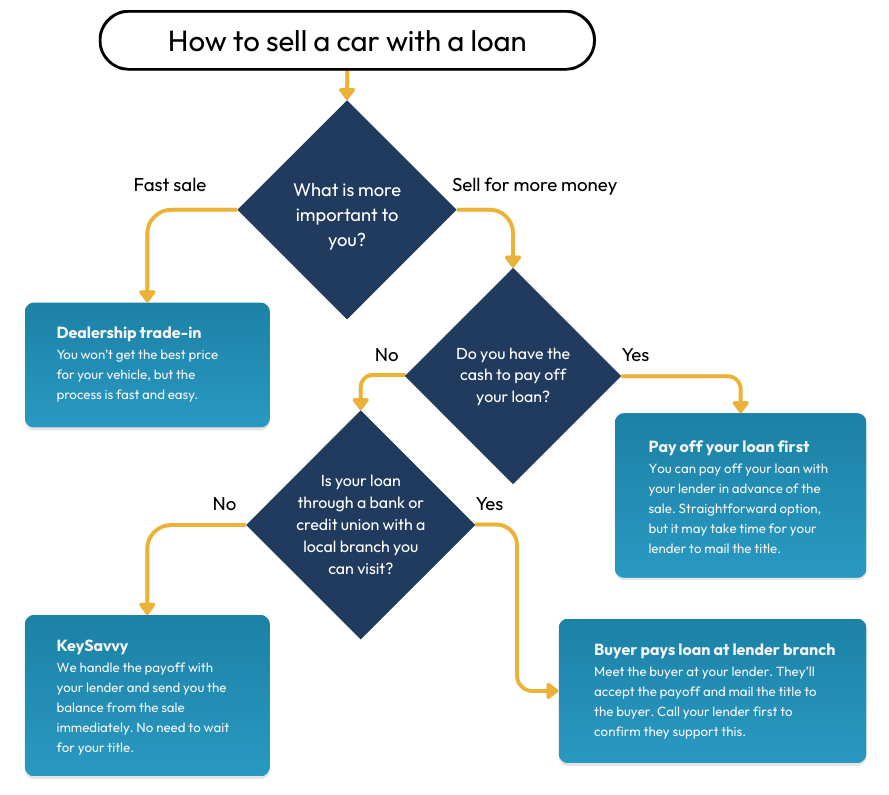

Selling a car you still owe money on can feel confusing because your lender still holds the title. Until the loan is paid off, you can’t simply hand the title to a buyer, and most buyers aren’t comfortable waiting weeks for paperwork. The good news is you have more options today than you did in the past.

This guide explains the three safest ways to sell a financed car to a private buyer, along with the pros and cons of each. It also includes an option to sell or trade your car to a dealer if speed matters more than price.

At a glance: your three main options

- Option 1: Pay off your loan first

Best if you have cash and want the cleanest, simplest sale. - Option 2: Work with your lender to support the sale

Works mainly with smaller banks or credit unions that allow in-person closings. - Option 3: Pay off your loan at the time of sale

Fastest private party option if you use a service like KeySavvy that handles the payoff and title transfer for you.

Option 1: Pay off your loan first

If you have the cash available and can wait for your lender to release the title, paying off your loan before you list your car is the most straightforward approach. Once the title arrives, you can show it to buyers and complete the sale like any other private party transaction.

Some articles suggest taking out a personal loan to pay off your auto loan. This rarely makes financial sense. Unsecured personal loans usually come with higher interest rates, and opening a new credit line can temporarily affect your credit score.

Pros

✅ Simple process with minimal paperwork

✅ Buyers feel confident because the title is already in your hands

Cons

❌ Requires paying your full loan balance upfront

❌ You may wait several weeks for your lender or DMV to mail the title or lien release

Option 2: Work with your lender to sell to a private buyer

Some smaller banks and credit unions will help facilitate a private party sale. This typically means both you and the buyer meet at a branch. The buyer pays the lender directly, the lender processes the payoff, and then mails the title to the buyer or the DMV.

Large national lenders usually do not support this type of in-person transaction, so you should check in advance before listing your car.

Pros

✅ Lets you sell to a private buyer without paying off your loan yourself

✅ Helps you maximize your sale price

Cons

❌ Common only with smaller, local lenders

❌ Buyers may feel uneasy waiting for the title to arrive after payment

❌ The sale may take longer to complete compared to a dealer transaction

Option 3: Pay off your loan when you sell

Using KeySavvy allows you to sell your car privately without paying off your loan in advance. Your buyer pays through KeySavvy, and we send the payoff to your lender and manage the title transfer. You and the buyer can complete the transaction as soon as you agree to the sale, even if your lender holds an electronic title.

This option is especially helpful for out-of-state sales or situations where the buyer wants reassurance that the payoff and transfer are handled correctly.

Pros

✅ No need to pay off your loan upfront

✅ No waiting for your title or lien release before handing over the car

✅ KeySavvy handles the payoff and title paperwork

✅ Works with most major lenders, including electronic-title states

✅ Lets you sell on any marketplace, typically getting a higher price than a dealer

✅ Flat fee of $99 for paperwork and coordination with your lender

Cons

❌ Selling privately usually takes longer than selling to a dealer

Option 4: Sell or trade in to a dealer

If speed is your priority, selling or trading your car to a dealer is the fastest option. The dealership will handle the payoff directly with your lender.

Pros

✅ Quick and convenient

✅ No paperwork for you to manage

Cons

❌ Dealers pay significantly less than private buyers

❌ You may leave thousands of dollars on the table compared to a private sale

Final thoughts

Selling a financed car is absolutely possible. The key is choosing the option that fits your timeline, comfort level, and financial situation. Be upfront with buyers about your loan and the process you plan to follow. Clear communication prevents surprises and helps the sale go smoothly.

If you think you may owe more than your car is worth, take a look at our guide to selling a car with negative equity.